Our Southwest Florida Market Report for August 2022 includes the latest real estate data, as well as a comprehensive list of market conditions in SWFL. From inventory and sales activity to market trends, it all comes together in this monthly market report. Stay up-to-date and plan ahead with our monthly market reports!

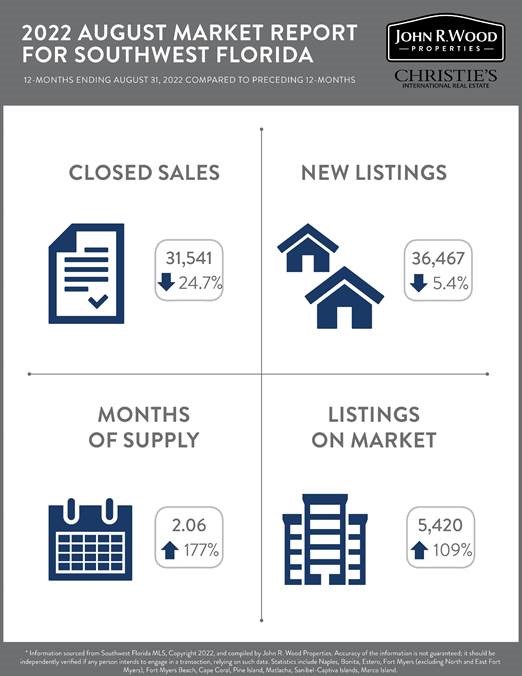

Closed Sales

Closed sales for the 12-month period ending August 31, 2022 were down 24.7% from the preceding 12-months, from 41,906 to 31,541. The 1,876 sales posted for the month of August were down 30.8% when compared to August of 2021, a time when the market was still posting a record-breaking sales pace. Compared with pre-pandemic trends, August sales were down 13%.

Listing Inventory / New Listings

As of August 31, 5,420 properties were available, up 108.8% from a year prior but down 2% from the prior month. New listings for the 12-month period ending August 31, 2022 were down 5.4% from the preceding 12-months, from 38,564 to 36,467. For the month of August, new listings were down 7.5% from August of 2021. 2.06 months of supply was posted as of August 31, 2022, unchanged from the prior month and remaining well into a sellers’ market territory. In Southwest Florida, 6 to 12 months of supply is generally considered a balanced market.

Average Selling Price

The average selling price for the 12-month period through August 31, 2022 was $745,219, up 22.5% from the preceding 12-month period when the average selling price was $608,210.

Perspective

Over the past 18 months, after the pandemic-driven frenzy peaked in early 2021, the Southwest Florida real estate market has steadily moved back toward a state of normalcy. The rate of newly pending sales returned to pre-pandemic levels in May, and in June and July trended below pre-pandemic levels resulting in fewer than normal closed sales during the following months. However, after that June and July slowdown, newly pended sales started to strengthen and, by the end of August, were once again in line with pre-pandemic trends. This ebb and flow isn’t unusual, and it may be a good sign considering it’s a shift from a trend which, up until that point, was one of deceleration in newly pending sales. After steady increases from the low in February, listing inventory plateaued in August, posting a modest decrease from July. This is due to steady sales absorbing available inventory, as well as to a somewhat slower than usual pace of new listings entering the market in August. Listing inventory, at 5,420 units as of August 31, has a long way to go before it returns to pre-pandemic levels and, with 2.06 months of supply, we are still firmly in a seller’s market.

Click here for the full market report