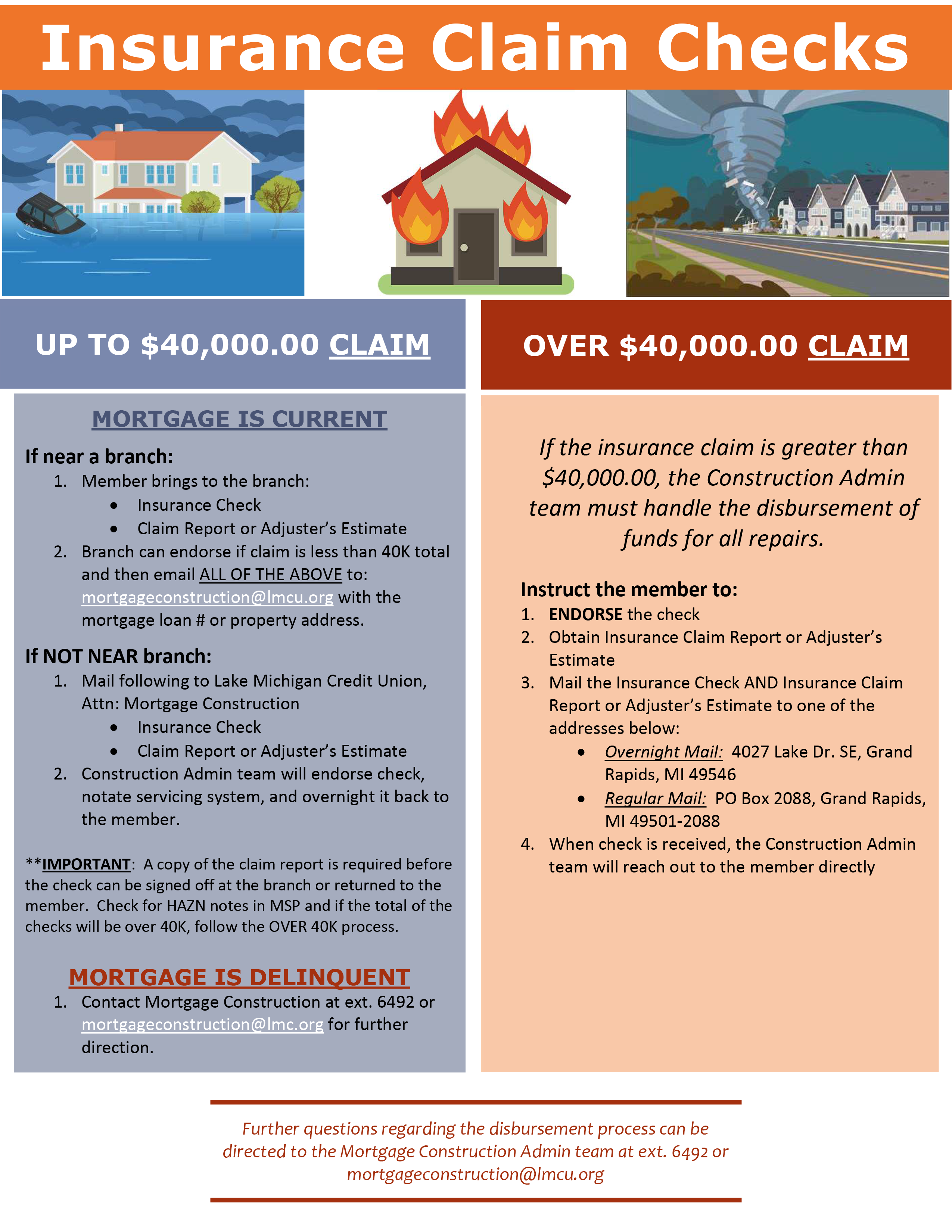

Click here to download the PDF version of Insurance Claim Checks

Have you been impacted by Hurricane Ian?

LMCU is dedicated to helping you navigate through these difficult and uncertain times.

Mortgage Assistance

If you are experiencing financial hardship due to Hurricane Ian and are in need of mortgage assistance, we are here to help you determine what options may be available to you. To speak to one of our Mortgage Loan Counselors, please contact us at 844-754-6280 ext. 9931.

Hazard Loss Claim

If your home has sustained damage, contact your insurance agent immediately to file a claim. After your claim has been filed, please contact our Construction Administration Team at 844-754-6280 ext. 6492 with your claim information so we can help you determine next steps. Claims over $40,000.00 will be administered by LMCU. Upon review of the Claim Report any claim funds received for contents, personal property, or living expenses will be released to you without delay.

Loan Currently In Process

If you currently have a new mortgage in process and have questions about how Hurricane Ian may affect the processing of your loan or the timing of your closing, your loan officer will be able to assist in answering these questions.

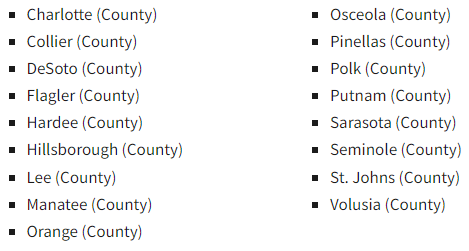

The following Counties have been declared Disaster areas by FEMA

What if my property is located in one of these counties?

If you had an appraisal completed prior to 9/30/2022, we will need to order a Catastrophic Disaster Area Property Inspection Report to verify that the home/condo/project did not suffer interior or exterior damage due to Hurricane Ian, prior to being able to close. This also holds true for a construction or vacant land loan; while a house may not yet be there, we want to ensure that the buildability of the land has not been impacted. Applications with an appraisal waiver will also need to have a Catastrophic Disaster Area Property Inspection Report completed prior to close.

What are the additional costs of this inspection?

LMCU is presently covering the cost(s) of these required inspections.

What if my rate lock is coming due and we cannot close in time?

LMCU is covering the cost(s) of rate extensions for a period of 15 additional days at no cost to our members for properties in the declared disaster areas. We will work with you on an individual case by case basis should additional extensions be necessary

Is there any additional documentation requirements?

Not at this time. Credit, income and asset verification requirements have not changed for those located in impacted areas.

Construction Loans Currently In Process

If your project has sustained damage, contact your builder and insurance agent immediately to file a claim. For additional information please contact your draw specialist or the Construction Administration Team at 844-754-6280 ext. 6492 to discuss extending the construction term, payment relief options as well as the insurance claim process.

Other Steps You Can Take Now

Sign Up for eStatements

eStatements are a convenient way to see all of your mortgage statements in one place, but it is also a valuable service to ensure you continue to receive your monthly statements should postal service become unavailable at your property. Signing up is easy. Simply log into your OnLine Banking Account at LMCU.org, click your mortgage loan, and then navigate to Account Management. Select Document Center and under Delivery Preferences, choose paperless statements and click “Let’s do this!”

Payment Methods

Be prepared during a disaster by making payment arrangements. In addition to sending a check or making a payment by phone, we have convenient payment options available right on our website. To set up automatic payments or make a one-time payment, simply log into your OnLine Banking Account at LMCU.org, click your mortgage loan, and navigate to the Payments menu.

Consider Applying for Aid Through FEMA

For those affected by Hurricane Ian, FEMA may be able to support your recovery. For more information about FEMA’s disaster assistance and support services, visit: fema.gov/assistance