Moving to a new home within Florida? You might be eligible to transfer your valuable Homestead Exemption along with the Save Our Homes (SOH) assessment cap, saving you significantly on property taxes. This benefit, known as “Portability,” ensures your property tax savings travel with you to your new primary residence in Lee County, Florida.

Step-by-Step Guide to Transferring Your Homestead Exemption:

1. Apply for a New Homestead Exemption

The first step is to submit a new Homestead Exemption application for your new primary home. This establishes your continued eligibility for significant tax savings.

2. Apply for Portability

Next, complete and submit the Portability Application (Form DR-501T). This crucial step officially transfers your SOH benefit (your assessment cap) from your previous Florida property to your new home.

Submit Portability Application

Important Deadlines & Eligibility Criteria

To ensure your portability is successful:

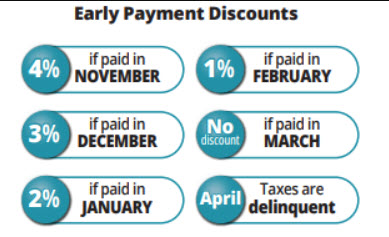

- March 1 Deadline: Your applications must be filed by March 1 of the tax year for which you’re applying.

- Previous Homestead Exemption: You must have held a Florida homestead exemption on your previous residence within the last three years.

- Transfer Limit: The maximum transferable amount of the SOH benefit is $500,000.

Need Assistance?

If you have further questions or need guidance during this process, Lee County Property Appraiser’s Office is ready to assist:

- Phone: (239) 533-6100

- Email: exemptions@leepa.org

- Website: Lee County Property Appraiser

Transferring your Homestead Exemption with Portability can make your move smoother and financially beneficial. Don’t miss out on your savings—apply today!